Healthcare demands drive domestic UK biotech investment

Posted: 11 May 2021 | Dmytro Spilka (Solvid) | No comments yet

Dmytro Spilka explains why UK biotech companies are receiving increasing levels of investment and why this trend is likely to continue.

As things stand, UK biotech companies are set for a record-breaking year of fundraising in 2021 according to the latest data gathered1 by the UK BioIndustry Association (BIA) and Clarivate.

Over £830 million in fresh capital was raised over the course of three months ending in February 2021, a significant proportionate increase compared to £894 million it took six months to raise in the first half of 2020 – which was a record-breaking year in itself.

Investors from around the world are continuing to buy into the potential of UK science, with both public and private companies alike placing significant volumes of money into their R&D programmes in a bid to accelerate the delivery of innovative technology and medicines across the industry.

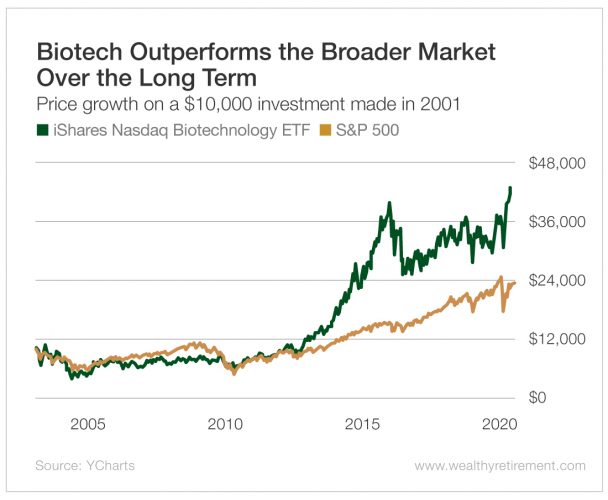

As the data shows, the trend of profitable biotech companies investing is not just isolated to the London Stock Exchange, with Nasdaq investments clearly accelerating away from the S&P 500 in recent years before spiking in 2020.

Credit: Investment U

Naturally, the COVID-19 pandemic has created unprecedented levels of interest and the necessity for advanced technology in the healthcare sector. The arrival of social distancing has called for remote technology that has never been more pertinent for users. However, the data shows even as we emerge from the other side of the health crisis, biotech investments are still on the rise in the UK. So are we only at the beginning of a transformative era for biotech investing?

Investor activity

One big indicator of a sector that is continually overperforming is access to capital, which has been extremely good for the UK’s fledgling biotech companies.

For instance, Avacta Group PLC raised £48 million2 in an oversubscribed share placing, while Tiziana Life Sciences found US support in its latest fundraiser, bringing in as much as £44 million.3 These cases highlight the hefty demand for fresh biotech companies across the investing landscape.

The flurry of buying activity has seen biotech investments hold strong during lockdown. Despite volatility leading to 34 percent of the FTSE 100 being wiped at the darkest point for the stock exchange, the whole of the AIM Healthcare Index climbed six percent over the course of mid-2020.

The COVID-19 pandemic has aided more investors in taking the time to place their savings into stock markets. This may be due to lockdown restrictions enabling more money to be saved, leading to unprecedented numbers of investors4 looking to buy into stocks that appear to hold great potential.

…the sector has continued to outperform its recent history”

Maxim Manturov, Head of Investment Research at Freedom Finance Europe, claims that his brokerage has seen significant levels of interest in the wake of COVID-19: “What we have analysed above actually looks like the consequence of the pandemic and the stimulation packages that followed. This created a pool of funds retail investors could start investing into stocks. As per Fidelity report, there were 26 million retail accounts in 2020, ie, up 17 percent compared to 2019, while the daily trading volume doubled.”

As more investors sought out ways to invest their money, more opted to buy into biotech firms and companies working on producing COVID-19 vaccines as a means of anticipating their growth in the wake of lockdown.

Vaccitech Plc, for instance, a biotech company that contributed to COVID-19 vaccine research, launched its IPO in the NASDAQ on April 29. More specifically, Vaccitech took part in developing the AstraZeneca vaccine. In listing Vaccitech’s IPO5 for prospective participants, Freedom Holding Corp. acknowledges that at a $16 to $18 per share price tag, the officials at the Oxford University are expecting this IPO to be the best start in the scientific R&D domain over the last few years. Currently, Vaccitech is trading at $14.10 per share.

Appreciating UK biotech stocks

Alongside the significant levels of investment, the biotech sector of UK healthcare is continually offering strong levels of returns for its financial backers.

According to an analysis by Radnor Capital Partners on behalf of the BIA, biotech companies quoted on the London Stock Exchange have consistently outperformed the FTSE-All Share by 256 percent over the past year, with listed investment vehicles, which are largely favoured by retail investors for the fact that they diversify risk, rising by 60.4 percent6 compared to the FTSE All-Share.

As the stock market rebound occurred as the pandemic began to ease in the UK, the sector has continued to outperform its recent history, with the FTSE All-Share rising by just four percent compared to 24 percent for the quoted biotech sector.

Steve Bates, Chief Executive of the BIA, said: “This record level of investment shows the vibrancy and strength of the UK life sciences ecosystem. Home to world leading companies and researchers, underpinned by a successful industrial strategy, this fantastic investment picture means the UK will continue to be a global player in bringing innovative treatments to patients and as a key economic engine, in the UK’s recovery from COVID-19.”

Investors from around the world are continuing to buy into the potential of UK science”

With the new UK financial tax year beginning, sector experts are anticipating UK biotech and life sciences companies, along with funds dedicated to investing into the sector will be a more popular location for retail investors moving forward.

As vaccines continue to be distributed7 across the UK, domestic biotech companies will begin to dedicate time towards adapting their technology to the era of the new normal – where remote healthcare and both augmented reality and virtual reality could be implemented to help the diagnosis and treatment of illnesses.

With biotech stocks consistently outmanoeuvring typical share prices, it is fair to say that there is a lot of potential still left in the market. If this momentum can continue to gather pace, then UK biotech companies deserve all the attention that they are earning in the world of investments.

About the author

Dmytro Spilka is a technology and finance writer based in London, UK. Dmytro is the founder of Solvid and Pridicto. His work has been published in Investing.com, IBM, Investment Week, FXStreet, Entrepreneur and FXEmpire.

References

- [Internet]. 2021 [cited 10 May 2021]. Available from: https://www.thepharmaletter.com/article/uk-biotech-set-for-another-year-of-record-breaking-investment…

- AVACTA GROUP PLC AVCT Stock | London Stock Exchange [Internet]. Londonstockexchange.com. 2021 [cited 10 May 2021]. Available from: https://www.londonstockexchange.com/stock/AVCT/avacta-group-plc/company-page?lang=en

- [Internet]. 2021 [cited 10 May 2021]. Available from: https://www.nasdaq.com/market-activity/stocks/tlsa

- More money poured into stocks in past 5 months than over last 12 years – BofA [Internet]. Reuters. 2021 [cited 10 May 2021]. Available from: https://www.reuters.com/business/more-money-poured-into-stocks-past-5-months-than-over-last-12-years-bofa-2021-04-09/

- Participation in online IPO – Vaccitech Plc (VACC_IPO) [Internet]. En.freedom24.com. 2021 [cited 10 May 2021]. Available from: https://en.freedom24.com/ipo/vaccitech-plc-ipo

- [Internet]. 2021 [cited 10 May 2021]. Available from: https://www.thepharmaletter.com/article/uk-biotech-set-for-another-year-of-record-breaking-investment

- Covid vaccine: How many people in the UK have been vaccinated so far? [Internet]. BBC News. 2021 [cited 10 May 2021]. Available from: https://www.bbc.co.uk/news/health-55274833

Related topics

Biopharmaceuticals, Funding, Legal & Compliance

Related conditions

Covid-19

Related organisations

Avacta Group, Clarivate, Freedom Finance Europe, Freedom Holding, Radnor Capital Partners, Tiziana Life Sciences, UK BioIndustry Association (BIA), Vaccitech

Related people

Maxim Manturov, Steve Bates